All Categories

Featured

Table of Contents

If you take a distribution against your account before the age of 59, you'll likewise need to pay a 10% penalty. The internal revenue service has actually enforced the MEC policy as a method to stop people from skirting tax responsibilities. Limitless banking only functions if the cash money value of your life insurance coverage policy remains tax-deferred, so see to it you don't turn your policy into an MEC.

When a money worth insurance policy account categorizes as an MEC, there's no chance to reverse it back to tax-deferred condition. Limitless financial is a sensible idea that offers a range of benefits. Right here are a few of the pros of this special, individual financing financial system. A non-correlated possession is any kind of possession not tied to the securities market.

You can profit of unlimited banking with a variable global life insurance policy or an indexed global life insurance plan. But given that these kinds of plans link to the supply market, these are not non-correlated properties. For your policy's cash money value to be a non-correlated possession, you will need either whole life insurance coverage or global life insurance coverage.

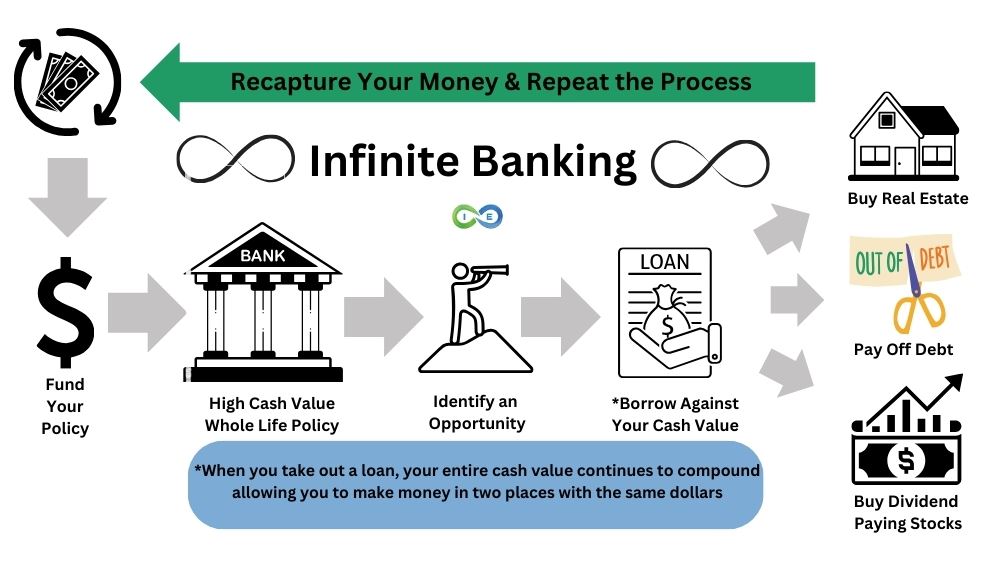

Before picking a plan, find out if your life insurance policy firm is a mutual firm or not, as only mutual companies pay returns. You will not have to dip right into your savings account or search for lenders with low-interest prices.

What resources do I need to succeed with Policy Loans?

By taking a finance from you instead of a conventional loan provider, the debtor can conserve hundreds of dollars in interest over the life of the loan. (Simply be sure to bill them the same rate of interest that you need to pay back to on your own. Otherwise, you'll take an economic hit).

Due to the fact that of the MEC regulation, you can not overfund your insurance policy as well much or also promptly. It can take years, if not years, to develop a high cash money value in your life insurance coverage policy.

A life insurance plan ties to your health and wellness and life expectancy. Depending on your clinical history and pre-existing problems, you may not certify for a long-term life insurance coverage plan at all. With unlimited banking, you can become your own lender, obtain from on your own, and include cash money value to a permanent life insurance coverage plan that expands tax-free.

When you initially find out about the Infinite Banking Idea (IBC), your initial response may be: This sounds too excellent to be real. Perhaps you're skeptical and think Infinite Banking is a rip-off or system. We want to establish the document right! The issue with the Infinite Financial Principle is not the idea however those individuals supplying an adverse critique of Infinite Financial as a concept.

As IBC Authorized Practitioners with the Nelson Nash Institute, we thought we would certainly answer some of the leading inquiries people search for online when learning and understanding everything to do with the Infinite Banking Principle. So, what is Infinite Financial? Infinite Banking was developed by Nelson Nash in 2000 and fully described with the publication of his book Becoming Your Own Lender: Unlock the Infinite Banking Idea.

What is the minimum commitment for Infinite Banking?

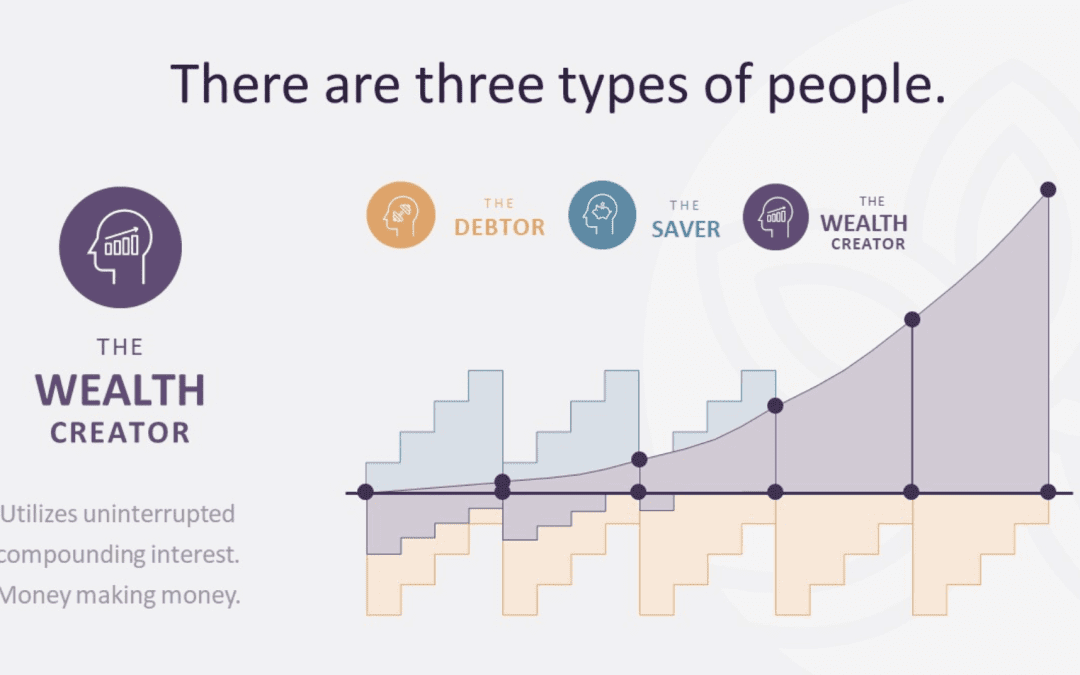

You assume you are coming out financially ahead since you pay no rate of interest, yet you are not. With conserving and paying cash money, you might not pay interest, but you are utilizing your money once; when you invest it, it's gone for life, and you give up on the opportunity to earn life time substance rate of interest on that cash.

Billionaires such as Walt Disney, the Rockefeller family and Jim Pattison have actually leveraged the buildings of entire life insurance that dates back 174 years. Also banks utilize whole life insurance for the exact same objectives.

What is Self-financing With Life Insurance?

It enables you to generate wide range by fulfilling the banking feature in your own life and the ability to self-finance major way of life purchases and expenditures without disrupting the substance rate of interest. Among the most convenient methods to assume about an IBC-type getting involved whole life insurance policy policy is it approaches paying a mortgage on a home.

Over time, this would create a "continuous compounding" impact. You understand! When you borrow from your participating entire life insurance plan, the cash money value remains to expand nonstop as if you never ever obtained from it to begin with. This is since you are utilizing the money value and survivor benefit as collateral for a financing from the life insurance policy company or as collateral from a third-party lender (known as collateral borrowing).

That's why it's vital to function with a Licensed Life Insurance Broker accredited in Infinite Banking who structures your participating whole life insurance policy properly so you can avoid adverse tax effects. Infinite Banking as a monetary method is not for every person. Below are some of the advantages and disadvantages of Infinite Banking you need to seriously think about in deciding whether to progress.

Our favored insurance policy provider, Equitable Life of Canada, a mutual life insurance business, concentrates on taking part entire life insurance policy plans certain to Infinite Banking. In a shared life insurance coverage firm, insurance policy holders are taken into consideration business co-owners and get a share of the divisible surplus generated every year through dividends. We have a variety of service providers to select from, such as Canada Life, Manulife and Sunlight Lifedepending on the needs of our customers.

What financial goals can I achieve with Wealth Management With Infinite Banking?

Please also download our 5 Top Inquiries to Ask A Boundless Financial Representative Before You Work with Them. For additional information regarding Infinite Financial visit: Disclaimer: The material provided in this e-newsletter is for educational and/or educational functions only. The details, opinions and/or views shared in this newsletter are those of the writers and not always those of the supplier.

Latest Posts

Nash Infinite Banking

Cash Flow Banking, Infinite Banking, Becoming Your Own ...

Life Insurance Infinite Banking